It’s a bit controversial among the Personal Finance community that I’m not striving for the FIRE life. In case you’re not familiar, FIRE stands for Financial Independence Retire Early. The concept has been quietly brewing for decades but has really picked up steam in the last few years.

Boiling it down, the tenet of FIRE is to amass enough money/wealth to, well, retire early. Many of the FIRE bloggers retired before they were 40 and some even before 30. How is this possible, you ask? There are many factors; some invested in rental property, some created products, some invested in the stock market. There can be many paths. Most of the paths though have a couple of things in common.

The typical FIRE seeker aims to save a large portion of their income by reducing their cost of living. After retirement, they maintain the lower cost of living while drawing on their investments. Many of the FIRE bloggers saved 50–70% of their income, invested in the stock market or real estate and retired with $1+ million bucks (or whatever their 4% rule number is — more on this later) to travel the world.

The dream of retirement is to have idle time and to travel. Swap frantic mornings with quiet coffees. We still see the standard retirement ideal on commercials targeting our parents — a white-haired couple wearing polo shirts, sitting on the deck of a sailboat in a sunny locale. The image of FIRE for our generation is strikingly similar: good-looking couples living the bohemian van-life sipping coffee as the sun rises over a serene lake.

What’s not to like?

Um, a lot, actually.

Major drawbacks of FIRE are geography and budgets

Many FIRE individuals do indeed travel after retirement. And travel affords them the ability to retire because of what they call Geographic Arbitrage. They trade living in an expensive city to travel and live in less expensive cities; trade NYC for Phuket, Chicago for Belize City. Very popular FIRE bloggers at Millenial Revolution traded in the typical dream of buying real estate in Toronto to invest in their retirement fund and now gallivant all over Asia. Their cost of living is lower because they don’t live in a big city where costs inevitably run high. Instead, they opt for Asia cities with lower costs or favourable exchange rates.

This solution isn’t for me. Don’t get me wrong, I love to travel. Everyone at work knows me for my crazy trips; instead of going to an all-inclusive in Cuba, I’m off to East Africa instead. Travelling is awesome and the only thing I like to collect is stamps in my passport. Vanlife seems full of adventure too; road tripping, picking up and moving on a whim. But my family is here; in an expensive North American city. My mom is older and I don’t want to regret not being here for her. My niece is also very young. I want her to have lots of memories of me playing with her, teaching her little things. I don’t want to just be the highlights reel. So being away from them for 6+ months at a time is not an option for me.

Many FIRE bloggers swear by the 4% rule. This rule is that you can withdraw 4% from your portfolio every year with little chance of “running out”. So if taking out 4% of your investment is enough to cover all your living expense, you can retire.

The reason this does not appeal to me is that living the rest of my life on a fixed income budget doesn’t sound like a lot of fun. You know the stereotype of the couple in Florida eating dinner at 4 to take advantage of “early bird pricing” because they are on a “fixed income?” Yeah, no thanks.

And from an emotional standpoint, the reason I entered Finance when I graduated was that I didn’t want to live the rest of my life worrying about bills and how to pay them. I was also afraid to be one of those old ladies eating tins of cat food because I hadn’t saved enough. Ever since I had a full-time job, I saved for retirement. I have a good nest-egg, but a pensioner’s greatest worry is outliving their retirement portfolio. This is called longevity risk. Retiring early increases my longevity risk.

Finally, the reason I’m not about the FIRE life is that not everyone can save 50–70% of their take-home pay. Many of the FIRE bloggers were able to do so because they had a significant other. Furthermore, their partner earned income as well. But duel income households are no longer the norm.

Statistics show that in Canada, single households now outnumber family households. More individuals are now single, either by choice or by circumstance. They don’t have the luxury of sharing all of their household expense with another and reaping the benefits of economies of scale. I spent most of my twenties and thirties being a single income earner. Am I condemned to toil endlessly since a savings rate of 50% is out of reach?

What to strive for instead?

So if FIRE isn’t a goal, what is? Well, I don’t think spending years of my life looking forward to retirement is the point. I choose to concentrate on the independence aspect of the equation. I am concentrating on Financial Independence. Not so I can retire, but counter-intuitively, so I can begin my work life. Instead of working for someone else’s dream, I can work to pursue my own. To find work that provides meaning to my life. In my case, it is work that gives something back to the world.

When we look deeper at what we admire about retirement, it’s the freedom of choice. Many people think retirement means endless free time and that is the goal. But if we actually take a closer look, it’s the opposite. Some FIRE retirees stay home and raise their children. This is meaningful work. Many retirees, traditional or FIRE, take up charitable work and volunteer. They find something that aligns with their values and interests. What they have and what we want is personal agency. It’s not retirement that bestows this; it is the financial independence.

Don’t get me wrong, I fantasize about early retirement on Monday mornings. Who doesn’t? The prospect of starting another week at the office is a real drag. I’m the typical knowledge worker; I don’t think I’m unique when I say that I am probably only fully engaged and excited about something about 20% of my workday. The other 80% is filled with those boring meetings and administrative tasks of filling out expense reports or updating some database. Because of the nature of office work, this boring ancillary work needs to be done to keep the business running, but it’s not what energizes me.

This is most employees’ experience. We think we’ll be happy when we are retired and can spend time doing whatever we want. But that is a fallacy because happiness is not what we think it is. Most people experience positive emotions when they are “in the zone”; they are focused, they are optimally challenged in a task, they lose track of time. This experience is called flow.

We experience flow when we are lost in conversation or in a good book. We can experience it while painting or building models. But scientific findings reveal that we are more likely to experience this state while at work. Each of our flow experiences will vary. But what if our work could be comprised mostly of engaging tasks instead of energy-sucking ones? Would we still long for retirement?

And finally, the reason that early retirement is not for me is that it doesn’t align with my values. The things that I truly value in my life are my relationships, my connections, and my contributions. Humans are social beings and we have a deep need to belong. Some people identify as belonging in the virtual FIRE community and that’s wonderful. I value the relationship with family, my friends and working to build strong social communities.

In conclusion

I wholeheartedly support financial independence for anyone who wants it. For me, financial independence need not mean independently wealthy. It means that I can exercise agency over my work and my time without money as the major obstacle. I know there are many ways to achieve it and it may take many different forms. Some want to travel; some may want to spend many mornings in their pyjamas.

After all, that’s said and done, financial independence is just a means to an end. And the goal should not be to withdrawal from society and connection. Many of us came out of school idealistic, wanting to engage the world and maybe even to change it. Then we had to face our student loans and other obligations. This led us to take ‘good jobs’ with advancement opportunity. Maybe we had to make some trade-offs, taking that job at a major corporation instead of a small NGO. But what if go back to that younger self and not face the financial obligations? What would you take on?

So instead of aiming for a FIRE life, I’m working on my FISCAL plan. It is what I’ve coined the Financially Independent Second Career ALternative (FISCAL) life (is it super uncool to make up your own acronym? lol). This is a journey that anyone, no matter your circumstance, can embark. Won’t you join me?

I’m 100% with you here. Financial Independence is so much more than aiming to retire early. I never want to stop working, but I believe being financially independent unlocks creativity and allows us to take more risk to find work that we’re truly passionate about.

Absolutely – sometimes I think that when I gain FI, I might be able to be more honest at work & not engage in office politics and those are the “risks” I want to be able to take!

The notion of financial independence actually brings up an issue we never hear about, that being what is the meaning of life? Since that question might be too large, perhaps we can say what is the purpose of work? It appears to me through life of observation and reading and study, that we are made to work, and that we are fulfilled in many ways when we produce and serve others. This is true in societies the world over, even the ones that don’t use money or retire at 65. I know that I will never retire, I will just keep serving my family and others in different ways — but it’s still called work.

So true! Your comment reminded me of the census debate of housework not being classified as “work” but of course it is because it is done in service to the family. I completely agree with your observation as well; all over the world, people are actively “doing” to contribute to their community. If we even look at home at the unemployed or underemployed; their discontent is that they want to work and they can’t. Not that they want a life of leisure.

Here’s to never retiring!

FI Retirement Optional (RO) provides me options. I like what I do … But, having the extra cash makes my life easier. My dividends typically pay for unexpected expenses e.g. fixing catalytic converter etc.

I love the “option” framework! Absolutely, I see money not as an ends, but as a means. And having it provides options. Like in the Capital Markets, all options are paid for with hard dollars. So money buys options, literally and metaphorically!

fatFIRE or bust.

The key is not to base your future plans on someone else’s. What worked for them may not work for you. And vice versa. You’ve obviously figured that out.

We’re mid-to-upper 5-figure spenders as a family of four, but won’t FIRE without the ability to handle a six-figure budget with a reasonably low SWR. That makes us futureproof enough in my estimation. But if I didn’t enjoy a good salary as I do now, I’d probably be singing a different tune. To each, his (or her) own.

Cheers!

-PoF

You hit the nail right on the head, PoF – “Not to base your future plans on someone else’s”. That goes for FIRE and that goes for traditional retirement at 65. That’s all someone else’s plan. I definitely advocate for finding each their own!

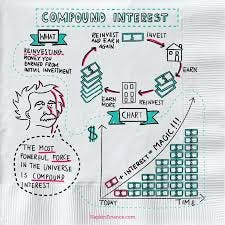

It’s not quite true that you lose the power of compounding when you begin a withdrawal plan on your assets. It all depends on the withdrawal rate and the rate of return on those assets. Something earning 8%, on average, whilst being withdrawn at a 4% rate, means that the balance must be compounding at 4%.

I don’t disagree. But going forward it’s hard to think of an asset allocation that’ll get to 8% return. Barring significant earnings growth to catch up to rich PEs, price growth for stocks might be muted. And fixed income, well….

I think the main thing about being financially independent is the ability to quit a job – whether to retire or simply to change career – whenever that job gets too boring, too stressful or too unbearable (due to harassment or discrimination, for example). If I had been financially independent sooner, I would not have had to take years of psychological harassment and de-valuing, and simply would have quit in my mid 40s and not looked back. I retired at 54 and my only regret is not to have left sooner. For me, work was indeed a four-letter word.